When do you worry about the value of your property? When you want to sell or considering such a move is one time. However, that is not the only time. Sometimes, it is about feeling good about the value of your home. Sometimes, an expected valuation that you believe should get you a good loan on your property is the motivation. In all these situations, you need to improve the value of your property.

To do that, several property merchants argue that you don’t have to break the bank to improve your home. In fact, they caution people from overspending on a certain property. In some jurisdictions, there are property value caps. So, even if you spend a fortune, your value cannot improve beyond a certain point. Here are simple investments that can add a significant value to your home.

1. Upgrade appliances and broadband signal

The new markets for homes and properties, in general, is increasingly millennials. To appeal to them, you have to be cool. For a start, add energy efficient models on your house. Your HVAC is top on the priority list. Remember millennials tend to use unconventional methods of saving; not using something is not one of them. They want to use air conditioning, it had better be energy saving.

Again, top on the list of most youthful families is good WIFI. If your home has poor broadband reception, you are likely to get a poor valuation. Remember the internet is now a basic need.

If you need more recommendations for which appliances to update simply Ask Bongo for recommendations.

2. Outlook and first impression

If from a distance your property looks glum, you’ll have to price it lower to appeal to anyone. Work on the exterior of your house. Maintain your fences, keep it trim, and kept. Fix your roof, windows, and gates. Leaky garages, screeching doors, and leaking roofs are characteristics of a derelict.

Who will buy a ruin? Sadly, no one. General maintenance of your property is a responsibility. Even you, can you really stay in a rundown place where even opening a door requires a crowbar? Zillow predicts that a well-maintained property sells twice faster and fetches 5% more on its valuation, unlike unkempt houses that fetch less than their market value.

3. Modernize the bathroom

Even for personal gratification, the bathroom requires efficient models. Add water-efficient models and add a few more value to the bathroom. People are emotional about their bathroom and are likely to be convinced to up their bid for just installing a frameless shower or pendant lighting.

The investment in the bathroom must be reflective of your home value though. You don’t have to add a $20, 000 upgrade in a $200, 000 home. Most bathroom upgrades should take less than 5% of your property value.

4. Improve on your kitchen

Not just you who is ecstatic about a modern kitchen, most of us are. Ensure all essentials are there in your kitchen. Ensure the shelves are standard. Modernize your sinks and taps. When it comes to kitchen appliances, use energy efficient models. If you’re not sure which models are energy efficient and don’t want to perform the research yourself Ask Bongo.

5. Add a garden

Don’t just have it, maintain the garden. Keep it trimmed and make sure that overgrown bushes do not obstruct light. A garden may not necessarily be used, but it features prominently in home valuations. First, it gives the impression that the place is pet-friendly.

6. Double-glazed windows

It is now almost becoming a requirement in the property market. Valuations for properties with window frames and double-glazed windows is impressive lately. You don’t want to see your property value go down because of such a small investment. Zillow observed a 5% addition to your value when you install these windows. If your property value is $100, 000, you are likely to sell it for $105, 000 after installing the windows.

Conclusion

Sometimes, you don’t need to do a one-time upgrade because it is expensive. Instead, you can replace every old item with a newer and efficient model. If the water heater develops a problem, sell it and get a new one.

Before you make an upgrade, it is good to visualize how the output will look like. Sometimes, you don’t have an idea on what exactly you need to upgrade in your how or even how to go about it. Several solutions exist nowadays. For example, Render 3D offering a 3D simulation of property upgrade. The virtual 3D rendering helps you to approximate costs and engage more fruitfully.

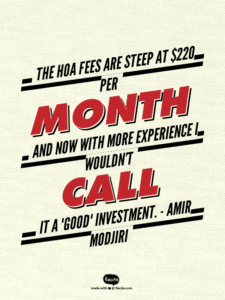

Amir Modjiri gives us his take on his first real estate investment. A small condo that was move-in ready.

Amir Modjiri gives us his take on his first real estate investment. A small condo that was move-in ready.