The real estate market has been drawn onto the technology bandwagon, albeit unwillingly. Governments have opened land registers to the public. Planning and mapping departments have also digitized their registries.

It is now easier to find a location on a map without the help of a surveyor. You can also view actual pictures and videos of a property to help you decide. Similarly, it is also possible to transact on a property without physically seeing it.

Technology has changed the way the industry runs for the better in several ways. The realtor is slowly turning into an advisor. The real estate agents are becoming obsolete, as we knew them. With the information age, we have better access to information. This includes title records, maps, and ownership records. Online tools and reviews make it easier to obtain information about the property.

The role of the agent has evolved from providing information. It is to provide guidance including analysis, commentary, and reviews on suitability for a purpose. This enables property owners to dodge brokerage fees and find clients quicker. A broader market also means better matches between tenants and landlords.

Property search engines are revolutionizing the way the markets have traditionally operated. It is like a big library of global real estate. Sites such as Zillow enable buyers to search for property on choice markets across the globe. They empower property owners to market their properties to more targeted audiences. The user can get property price histories, value estimates, close aerial view of the property, as well as prices of similar properties in each area.

The services also aggregate available public records including size, building plans and modifications to the property. This means people can process more transactions quickly. It also helps keep property records updated with real time information. Buyers can easily compare pricing models across property lines and locations.

Connectivity means more people can work from home. The adage of moving to a new house to be near work no longer applies. Telecommuting, freelancing, and consulting jobs are becoming more popular. Traditional dynamics on the commercial and residential markets are fading. This disruption is forcing developers back to the drawing boards, literally.

An emerging trend is the promotion of work, live and play or mixed-use spaces. Access to better technology and resources will keep driving the rural-urban migration pattern.

Technologies such as 3D rendering are enabling quicker and realistic demonstrations of proposed developments. They allow you to view the actual proposed architectural plans. Renders 3D Quick is a provider of high-quality visual concepts that include interior and exterior designs, 3D floor plans, landscape, and garden design as well as aerial renderings of the project.

There is a push to have more information on mobile platforms. Consumer demand is driving the mobile market. Service providers are scrambling to keep up. The future of the industry will lean heavily on mobile technologies. Real estate service providers will need to address utility value concerns in their service offerings to exploit the mobile revolution.

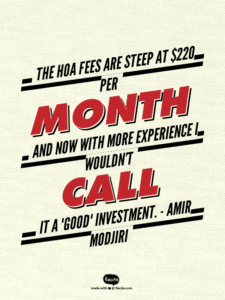

Amir Modjiri gives us his take on his first real estate investment. A small condo that was move-in ready.

Amir Modjiri gives us his take on his first real estate investment. A small condo that was move-in ready.